The Evolving Global Landscape of iGaming Regulations: A 2025 Deep Dive

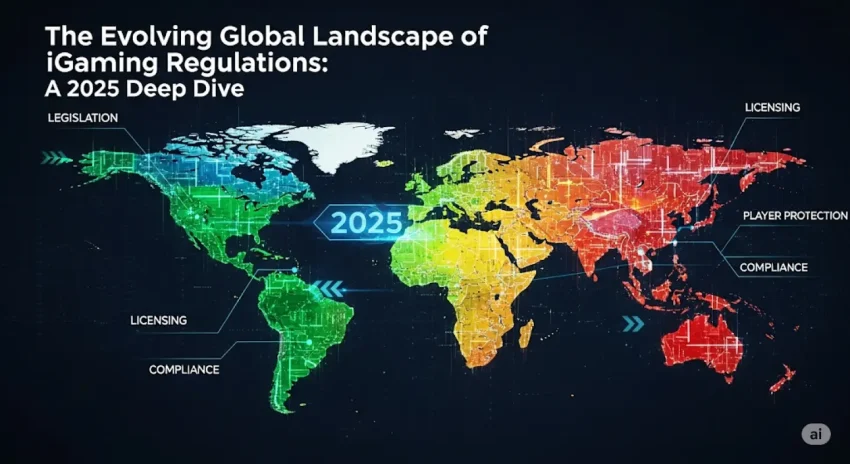

As a digital frontier that was characterized by swift growth in the past and flexible boundaries, the global iGaming industry experienced a paradigm shift. What initially was a highly dispersed and usually obscure regulatory environment has now grown into a complicated and tightly controlled world market.

This transition on the part of the operators is from a Wild West approach to a sort of obstacle course of regulations. This article will discuss the significant factors, the pillars, and strategic imperatives that will shape this new reality so that businesses, investors, and regulators may have a clear primer on what to expect.

Contents

The Paradigm Shift: From Ambiguity to Stringency

The worldwide iGaming industry is a juggernaut and is projected to have a yearly worth of about 40 billion US dollars. This economic impact that results in the formation of employment opportunities and the generation of billions in taxes to the state is the major reason why the interest of states to be formally regulated is also increasing. 2025 is a turning point, as the decade is characterised by a new form of global wake-up call and a preoccupation with leaner, faster, and exceptionally detailed regulatory systems.

This transition is based on a two-fold motive: governments desire to optimize tax revenue on the booming industry and, at the same time, strengthen consumer protection to reduce social harms. This has provided real-time checking of compliance, licensing mazes, and market regimes that may change overnight. The point is clear enough: it is no longer an option but a necessity to count on constant adaptation.

Categorizing the Global Market

To navigate this landscape, it’s essential to understand the three broad categories of global iGaming markets:

- Legal and Regulated Markets: Jurisdictions that are quite prolific in issuing licenses and forming regulations. Such as the United Kingdom, Sweden, and an increasingly long list of others, with about 79 markets in the world. They are deemed to be the safest for both operators and players since it is under rigorous supervision.

- Unregulated/Grey Area Markets: States that neither penalize nor have a strict regulation of iGaming. These are the markets of approximately 46 where players can usually gain access to offshore platforms; their legal status remains ambiguous and prone to change. Even jurisdictions previously in this band, such as Brazil and Curacao, are moving towards formal, tighter systems, which underscores the taxation appeal of legalization.

- Prohibited Markets: Countries that are outright prohibited from gambling online usually have with reason, to cultural or religious grounds. These 70-odd markets give rise to high levels of black markets to satisfy the unmet demand for gambling services.

Core Pillars of Modern iGaming Regulation

The modern iGaming regulatory framework is built on three foundational pillars: Licensing, Consumer Protection, and Anti-Money Laundering (AML).

1. Licensing and Operational Requirements

The regulators, such as the Malta Gaming Authority (MGA) and the UK Gambling Commission (UKGC), are of crucial importance. Licensing is not the mere application anymore; it needs solid due diligence. The operators are required to prove financial stability, data security, and successful player protection measures. This involves the presentation of evidence of adequate capital, an unblemished operating record, an evident business plan, and detailed policies in AML and social responsibility.

Costs of the application and procedures differ greatly. An example is the UK, where the UK introduced a tiered fee structure in Gross Gambling Yield (GGY), and where the maximum fee that the highest tier operators pay is over 793,000 per year. Malta, on the other hand, has a cheaper initial fee, but needs a physical local presence. A worldwide trend is the requirement of a real economic substance within the licensing jurisdiction, making it difficult for operators to simply seek the lowest-cost license without committing to a tangible operational footprint.

The driver in this new age of compliance is technology. Regulators have imposed advanced technological solutions such as:

- Biometric ID & KYC: Computer systems for identity verification.

- AI-Driven Analytics: Measures to track players to make sure of any fraud or problem gamblers.

- Secure Reporting Platforms: Systems for real-time compliance reporting.

This technological imperative poses a major entry barrier to smaller operators by advantaging larger operators with the financial resources to develop and operate advanced systems.

2. Consumer Protection and Responsible Gambling

The key focus of regulation is the provision of fair and safe gaming in an ethical manner. This is accomplished by:

- Robust Age Verification & KYC: There should be compulsory steps that curb underage betting.

- Responsible Gambling (RG) Measures: Mechanisms such as self-exclusion, limits on deposits, and the availability of the problem gambling helpline.

- Proactive Intervention: Reliance on AI, Big Data to analyze the gaming patterns and determine the players at risk before they cause substantial damage. Examples of such specialized software include Mindway AI and Playscan, which assign the operator the duty to act.

Such an evolution toward proactive regulation mitigates the distinction between a business and a public health service and obligates operators to invest heavily in data science and domain-specific software.

3. Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF)

The AML and CTF requirements are maybe the most globally unified and highly enforced area of iGaming compliance. Promoted by international organizations such as the Financial Action Task Force (FATF), these statutes play a pivotal role in restraining the usage of illicit funds.

Operators have no option but to adopt holistic programs to comply with AML, including:

- Know Your Customer (KYC): Identity and risk assessment of customers.

- Customer Due Diligence (CDD): Continuous observation of customer behaviour.

- Suspicious Activity Reports (SARs): Reporting of transactions beyond the specified threshold in time.

Compliance failure is met by tough penalties such as high fines and license suspension. The shared common baseline of compliance also occurs in less-regulated marketplaces since the transnational aspect of money laundering requires a universal response.

Key Regional and Market-Specific Trends

The fragmented nature of regulation is best understood through a regional lens.

Europe

Europe is a substantial market. Some countries with well-established regulated markets are Germany and Italy, whereas countries such as France are still struggling with the need to have state-controlled gaming since they are in the transition phase.

One of the main trends is that the tax burden of operators is growing. To provide a specific example, in Greece, where online channels of gambling have well entrenched themselves in the market, it is expected that the sector will reach an estimated amount of revenue of 1.3 billion by the end of 2025 as a result of the popularity of the Greek iGaming industry.

With the market flourishing, operators are anchored by tight compliance requirements such as a 35% Gross Gaming Revenue (GGR) tax and stringent responsible gaming measures that make the playing environment safe and fair to the players.

North America (USA & Canada)

The U.S. is an exceptionally complicated, state-by-state regulatory environment. When PASPA was repealed in 2018, it left each state the ability to legalize sports betting, leaving a quilt of 38 various regulatory systems. Such fragmentation is further compounded by extremely dissimilar tax rates and licensing fees. As an example, New York imposes 51 percent of taxes on online sports betting GGR, and Colorado charges a flat 10 percent. In Canada, the landscape is mostly governed by the provinces, and Ontario is one of its main licensed markets.

Latin America

Latin America is classified among the territories with tremendous potential. The new regulatory framework in Brazil, which became effective on January 1, 2025, is an echelon. Brazil will be a large, lucrative regulated market with an 18 percent GGR tax and a 4.8-million-euro licensing fee. Colombia is another dominating player, and since it is already a pioneer in the region, it is now viewed as one of the premier locations in the region, although it works under a decentralized provincial governance law.

Asia & Oceania

Asian regulation is very rigid, mostly banning them completely because of cultural or religious reasons. This tends to feed huge black markets. Nevertheless, markets are regulated in certain countries, such as the Philippines and India, and others are merely legally blurred, like in China. Australia has a significant ban on online casino games in Oceania, but sports betting is accepted.

The Taxation Imperative

Although it might seem like a worthy idea to protect the consumer, the main driving force of governments to get involved and alter or control the iGaming frameworks is the promise of pleasing amounts of tax income. This economic inducement is the reason why grey areas are turning into a part of a formally regulated market and why tax charges are rising constantly.

Taxation models vary widely and can include:

- Gross Gaming Revenue (GGR) Tax: A percentage of the revenue an operator earns from a game.

- Corporate Income Tax: Standard tax on profits.

- Withholding Tax: Tax on player winnings.

This revenue-first approach has been pointed out through the proposed rise of the online casino tax in the UK to 50 percent or the 51 percent tax of a state such as New York or Rhode Island. Operators have to incorporate such dynamic tax environments into their long-term monetary planning.

The Expanding Scope of Regulation

Regulators are expanding their concept of what is considered to be gambling. This is presenting new challenges with products formerly believed to fall outside the parameters of iGaming regulation:

- Sweepstakes Casino Games: Montana and New Jersey have enacted laws to ban or criminalize them, which define them as illegal iGaming.

- “Gambling-like” Elements in Video Games: Even features such as the presence of loot boxes and reward mechanics (e.g, the wheel in GTA V) are becoming a target of regulatory oversight. This movement shows the road leading to iGaming and video games regulation convergence, and developers have to carefully evaluate their monetization strategies.

- Crypto Gambling: There is no straightforward prohibition on winnings in many jurisdictions, but state tax authorities are increasingly considering winnings to be taxable income or property, which is within the jurisdiction of financial regulators.